PIPELINE

OPUS PROJECTS

OPUS PROJECTS

Using the OPUS technology, BioLingus develops oral versions of products which are currently only available in the form of injections, mainly in the areas of diabetes and obesity.

BioLingus expects that the conversion rate from injectable to oral formulations will be up to 80% (based on market research with endocrinologists and diabetologists) : in other words, it is expected that 80% of the patients who currently take the injectable forms, would switch to an oral form of these products.

Below you can find more details on each of our “core projects”.

Project : Sublingual Liraglutide (Phase 1b/2a)

Project : Sublingual Exenatide

Liraglutide and exenatide are both belonging to the class of diabetes products called GLP-1 analogues.

The GLP-1 analogues have established themselves in the past years as one of the superior drug classes for treatment of diabetes type II in terms of blood glucose lowering and weight loss.

Because of the latter, they are being used more and more also in the treatment of obesity.

Until now, both drugs are only available by injection. With the BioLingus drug delivery technology, both products are developed as orally available products.

Project : Sublingual Semaglutide

Semaglutide is currently the only GLP-1 product available as an oral product. Biolingus aims at developing a sublingual version of this product. This should have a substantially lower COGS and hence competitive with the oral version.

Project : Sublingual Dual Incretin Inhibitor (GLP-1/GIP)

Biolingus explores the development of a sublingual dual incretin inhibitor.

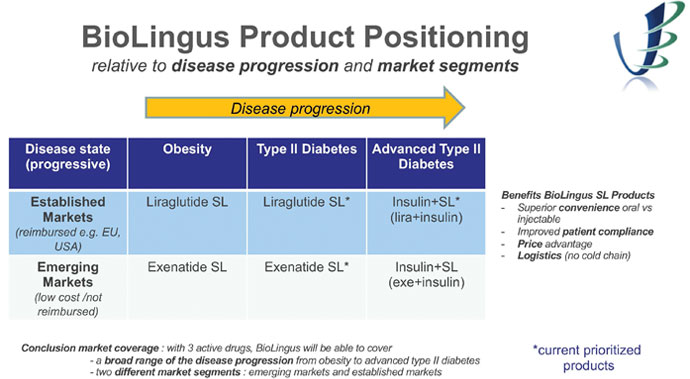

BioLingus will position these products in the “epidemic” markets of obesity and type II diabetes :

- More than 400 MM people suffer from diabetes today. The global type 2 diabetes market is expected to grow to $58.7 billion by 2025, with an annual growth rate of 6.5%, according to research and consulting firm GlobalData.

- According to WHO, more than 1.9 billion adults, 18 years and older, were overweight. Of these, over 600 million were obese. The global obesity treatment market is expected to reach USD 15.6 billion by 2024, according to a new report by Grand View Research.

Within this huge market, the market-segment for incretin analogues in diabetes and obesity is estimated at 12 Billion USD. Furthermore, it is expected that this market will further grow with new metabolic indications such as NASH and pre-diabetes. The sublingual liraglutide/semaglutide will be positioned in high priced/reimbursed markets while the SL exenatide will be positioned in lower cost/emerging markets where affordability and access are critical.

Project : Sublingual insulin+

(fixed dose combination product of insulin and exenatide/liraglutide).

The global human insulin market is projected to surpass USD 40 Billion USD. Our sublingual “insulin+” product will be positioned in a particular segment of this market : it will be prescribed for type II diabetes patients, who do not respond sufficiently to GLP-1 analogues alone.

Such a fixed dose combination is already on the market under the brand name Xultophy, which is a combination of insulin degludec and liraglutide injection.

Advantages of an insulin+ product over pure insulin are as follows :

- More stable blood glucose lowering

- Less risk of unacceptable variations and insulin overshoot